The Power of Zooming Out: Why Long-Term Perspective Wins in Investing

- scottdavidmillar

- Oct 31, 2025

- 3 min read

The single most valuable skill in building long-term wealth isn’t predicting what happens next. It’s learning to step back, zoom out, and keep perspective on what’s already happened and the opportunities that could be ahead of you.

That’s easier said than done. Even the most rational investors find it hard to stay calm when markets are moving sharply. Our brains are wired to focus on the present. Behavioural finance calls this recency bias - the tendency to believe that what’s happening now will keep happening forever.

Whether markets are rising or falling, this bias can lead to poor decisions. After a few good years, it’s easy to assume the good times will continue. After a sharp fall, it can feel like the world will never recover.

But evidence tells a different story.

Why Perspective Matters

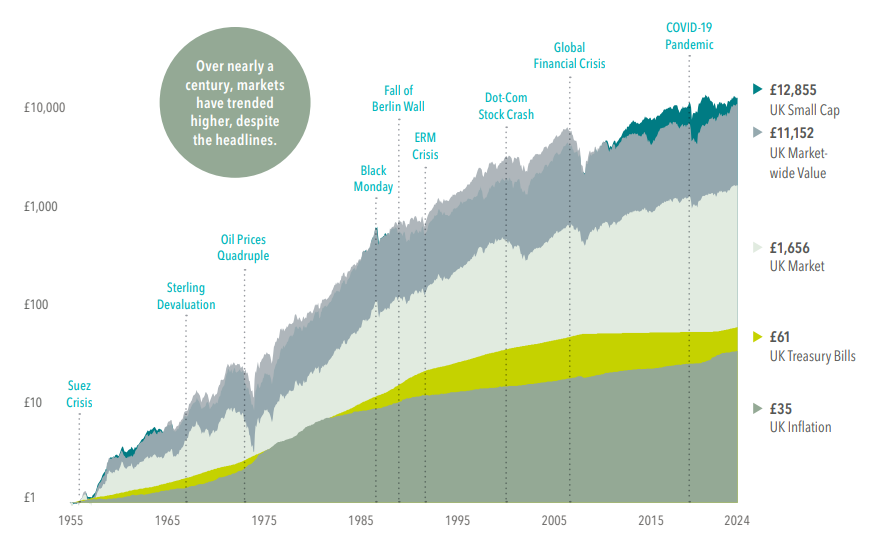

If you look at markets over months, they can feel chaotic and unpredictable. Zoom out to decades, and the story changes. The temporary noise fades, and long-term growth patterns become clear.

Every period of strong performance has been followed by weaker years, and every downturn has eventually recovered. Volatility isn’t a problem to be fixed, it’s part of how investing works - the trade-off for long-term returns.

Those who build real wealth aren’t the ones who avoid volatility. They’re the ones who expect it, plan for it, and stay the course when emotions run high.

What the Data Shows

We’re nearing the end of what could be the third consecutive year of strong global equity returns. That can create a false sense of confidence. When high returns start to feel normal, investors often build plans based on short-term optimism.

Yet history reminds us that markets move in cycles. Periods of strong growth are often followed by lower returns, sometimes even temporary declines. This isn’t pessimism - it’s realism. History, and plenty of research from firms like Dimensional and Vanguard, reminds us that markets move in waves. Good years don’t last forever, and neither do the bad ones.

Just look at the chart below, there have been periods where markets have struggled. But where are we now?

Stocks Have Rewarded Investors over the Long Term

You can’t predict when the next dip will come, but you can prepare for it - and that’s where good financial planning makes all the difference.

Building the Habit of “Zooming Out”

Developing this mindset takes discipline. It means resisting the temptation to react to headlines or short-term results, and instead focusing on your long-term plan - your number.

Before changing your investments, ask yourself:

Am I reacting to noise or to meaningful long-term changes?

Will this decision still make sense in five or ten years?

Does this move help me stay on track towards my goals?

A clear financial plan, grounded in evidence rather than emotion, helps you answer those questions with confidence.

How a Financial Planner Helps Keep You on Track

Working with a financial planner gives you an objective voice when emotions take over. A good planner helps you:

Define your number - the amount you need for financial independence or retirement.

Build an evidence-based investment plan designed to achieve it.

Stay disciplined when markets test your patience.

Review and adjust your plan as life and markets evolve.

At Finova Money, we help clients build and stick to long-term, low-cost investment strategies that align with their goals. We look at what actions we can take now that will give our clients the best probability of success in the long term. Our role isn’t to predict markets - it’s to help you stay calm, consistent, and confident through every market cycle.

The Bottom Line

The real power of investing comes from time in the market, not timing the market. When you zoom out, short-term noise gives way to long-term progress.

Have you considered whether your current plan helps you stay on track towards your number - or are you reacting to the latest market news?

If you’d like to explore how evidence-based investing and clear financial planning could help you build lasting wealth, we’d be happy to chat.

Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. While every effort is made to ensure details provided are accurate, Finova Money cannot guarantee the accuracy of the investment figures above.

Please obtain professional advice before entering into any new arrangement.

Comments